Examine This Report on Understanding the FHA Loan Maximum Limits in Texas

Getting through the FHA Loan Maximum Limits for First-Time Homebuyers in Texas

For first-time homebuyers in Texas, navigating the world of home mortgages can easily be discouraging. With therefore numerous options available, it may be challenging to establish which loan is appropriate for you. One choice that many first-time homebuyers switch to is an FHA car loan. These car loans are guaranteed by the Federal Housing Administration and supply many advantages, featuring lower down remittance demands and more tolerant credit history credit rating requirements.

Having said that, before you begin your hunt for your desire house, it’s important to recognize the FHA lending maximum limits in Texas and how they may influence your purchase.

What are FHA Loan Maximum Limits?

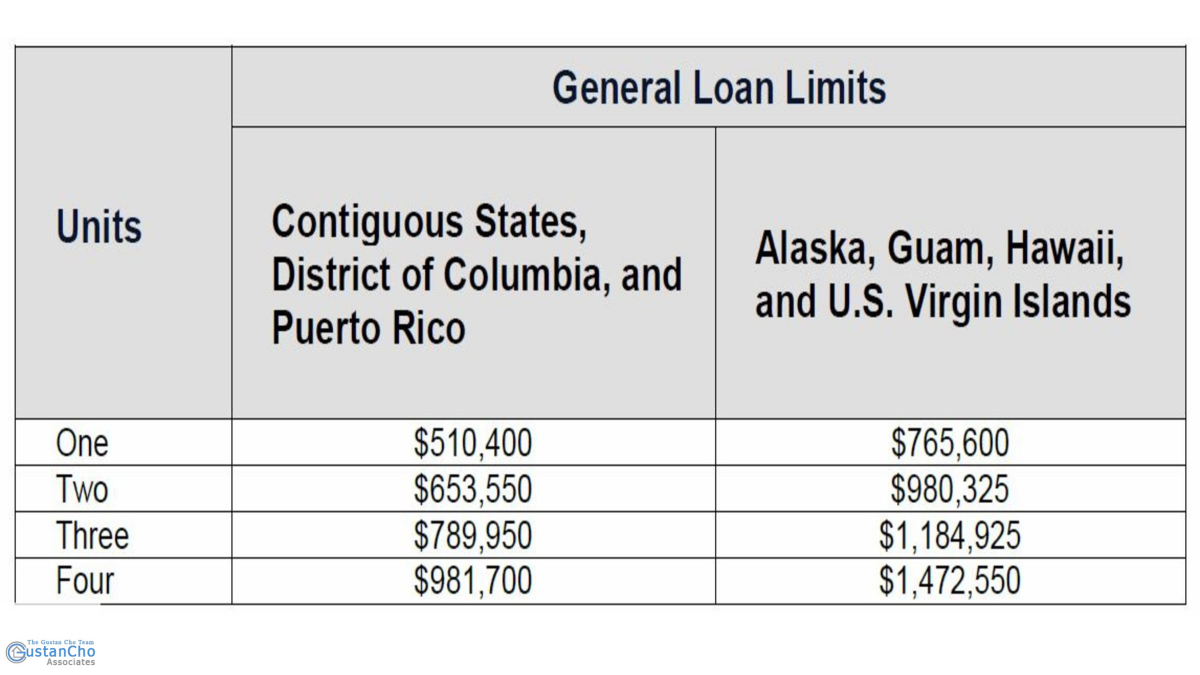

FHA lending the greatest limitations recommend to the optimal quantity of loan that a customer may borrow utilizing an FHA-insured financing. These limits vary through region and are based on typical property costs in each place. In Texas, FHA car loan the greatest limitations vary from $356,362 in low-cost areas to $822,375 in high-cost regions.

It’s significant to note that these restrictions use merely to single-family residences. If you’re looking to buy a multi-unit residential or commercial property with an FHA-insured finance, different the greatest limits apply depending on the number of systems.

Why Do Maximum Limits Matter?

Understanding FHA lending the greatest limits is critical when shopping for a house because they dictate how much money you may borrow along with this style of financing. If you’re looking at residences that surpass the the greatest restriction for your location, you will definitely either need to have to come up with a larger down settlement or think about various other financing choices.

Also, if you’re looking at houses near or over the optimal limitation for your place but have a lesser credit rating score or much higher debt-to-income ratio (DTI), you may possess difficulty certifying for an FHA-insured finance at all.

How Do I Discover My Place’s Maximum Limit?

To locate out what the existing FHA lending max limit is for your region in Texas, you can use the FHA’s website or speak to along with a home mortgage creditor. It’s important to take note that these limits can transform each year, so it’s consistently a good suggestion to check what the present limit is before beginning your home search.

How May I Stay Within My Maximum Limit?

If you’re looking to remain within your location’s the greatest restriction for an FHA car loan, there are actually numerous approaches you can utilize:

1. Determine Your Budget: Before starting your home search, take a difficult look at your funds and establish how a lot house you may reasonably afford. This will certainly assist you tighten down your hunt and guarantee that you’re appearing at homes within your budget.

2. Look for Homes Below Your Maximum Limit: Rather of concentrating on residential or commercial properties near or over the maximum limitation for your place, look for houses that are priced below this limit. This are going to offer you some wiggle space if there are any unexpected price or fees associated with closing on your brand-new house.

3. Consider fha mortgage limits texas : If the the greatest restriction in your area isn’t adequate to deal with the expense of the residence you really want, consider various other financing options such as traditional financings or VA loans (if suitable). These car loans might possess various requirements and rate of interest rates, thus be certain to do your analysis prior to producing a choice.

Navigating the world of mortgages as a first-time homebuyer can easily be baffling, but understanding FHA loan optimal limitations is an important step in protecting money for your dream house. By identifying what these limitations are in your place and taking measures to stay within them, you’ll be properly on your method to homeownership in no time!